Other Ways to Give

Planned Giving

Leave a Legacy of Kindness

A planned gift is a lasting investment in Feed My People, advancing our mission and ensuring our ability to provide food and other help to people crisis, as we have done for more than 35 years. We invite you to leave a legacy for tomorrow by considering one of the planned giving opportunities below.

Contact Us To Discuss Planned Giving Opportunities:

Stephanie Berberich, Executive Director, would be happy to answer your questions regarding Planned Giving and provide information on gift strategies that can help you support Feed My People’s mission to help individuals and families as they struggle.

- (314) 631-4900ext. 306

- StephanieB@fmpstl.org

Feed My People’s Tax I.D. number is 43-1264877

Include Feed My People in your Will or Trust

Give the gift that keeps giving long after you are gone. Individuals not have to be rich to leave a legacy of giving. They only need to define what matters to them, what creates passion within them. Deciding to make an ultimate gift (a gift made after death) offer all of us the chance to share who we are. It allows us to show our children and other surviving family members the importance of giving back. Finally, it gives joy and a sense of peace.

Charitable Lead Trusts

A charitable lead trust (CLT) is a gift of cash or other property to an irrevocable trust. Feed My People would receive an income stream from the trust for a term of years. Depending on how the trust is structured, you would enjoy a current income, gift, or estate tax deduction on the donated assets. After the income stream period ends, the remainder assets are distributed to the non-charitable beneficiaries. This gift is very good to make in the current economy as the lower the federal interest rate, the higher the income or gift tax deduction.

Change of Beneficiary Designations

A beneficiary designation is one of the simplest ways to make a gift to Feed My People. No need to get a lawyer. Its literally as easy as filling out a form.You can specify the individuals and charities you want to support and you can also specify the percentage of the assets you want each beneficiary to receive. Beneficiary designations are available when giving the following assets

Retained Life Estate

Through a retained life estate, you transfer ownership of your home or farm to Feed My People, while retaining the right to live in the property. With interest rates low, this gift has a lot of tax advantages for home owners.

Stocks & Bonds

Consider your long-term publicly traded stock for a charitable donation or ask your advisor about the best asset to contribute.

Donor Advised Funds

A donor-advised fund (DAF) is a philanthropic giving vehicle that provides an immediate tax benefit to you, and allows you to grant funds to charities of your choice.

IRA Charitable Rollovers

During this Christmas season, we celebrate faith, family and friends. Join Feed my People in proclaiming joy to the world, the Lord is coming!

Employer Match

Multiply the impact of your donation. See if your employer will match your donation.

Stocks, Bequests, Major Giving

Feed My People is supported by donations from individuals, schools, churches, businesses, and community groups including the Governing Board and Foundation Board. The majority of our support comes from individuals like you. You can financially support Feed My People through any of the following ways.

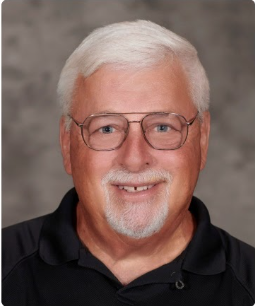

Retained Life Estates Make (Cents)!

“I love Feed My People. I am removing the hassle of selling my home from my children after I am gone. I will live in the home for the rest of my life, but after I am gone, it becomes Feed My People’s and I get a $92,000 tax deduction on a $120,000 house. Feed My People serves people in a way they know their dignity is intact.”